Phil Rongo: June 16th 2025

Weekly Economic and Stock Market Commentary

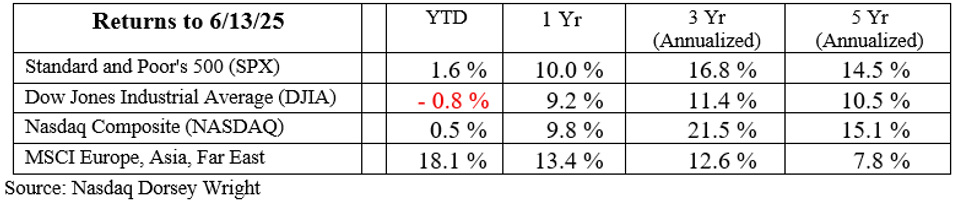

As for the stock market specifically:

Friday’s action turned market gains into losses. Even the white-hot international markets lost some ground last week. As someone who rarely goes into attribution, I think it is pretty easy to attribute Friday’s losses to the air and missile strikes occurring in the Middle East. I think it was mere coincidence that this happened on Friday the 13th, and not stock market triskaidekaphobia.

This week brings the quarterly quadruple witching.

That normally entails more volatility than usual. As stated often, we generally like volatility in the up direction, and don’t care for it in the down direction.

You may or may remember that I track 6 major asset classes. There isn’t much commentary about them because they don’t change positions very frequently. Last week saw international markets pass commodities as the 2nd strongest asset class and subsequently tie US stocks for 1st place.

My risk assessing tools are on offense and improved over the past week. Field position is good at this time. I continue to recommend WEALTH ACCUMULATION for clients.

Remember, Xs means OFFENSE or wealth accumulation, while Os means DEFENSE, or wealth preservation.

On a general note:

The Department of Labor had its monthly inflation week. Instead of giving 2 paragraphs of numbers with comparisons to the economists’ anticipated numbers, I am going to simplify the report this week. May inflation numbers – monthly and year-over-year, headline and core, consumer and producer – all came in better than expected by 0.1%.

%20(1080%20x%20250%20px).png)

Phil Beat The S&P 500... 8 YEARS IN A ROW!

THE RESULTS SPEAK FOR THEMSELVES

👉

Verified by Nasdaq Dorsey Wright and The Spaulding Group:

There’s about a 0.000026% chance that money managers will beat the S&P 8 years in a row... and Phil just did it.

One Million Dollars

Invested 2017-2024 would be:

S&P 500: 3.02 Million

Berkshire Hathaway: 2.78 Million

CORE OEX 4.08 Million

❌

✅

❌

If you’ve ever wondered “Am I still on the right track?” now’s the time to ask...

💼 The Bottom Line: You Deserve the Best

Our mission is simple:

🔹 To provide you with tax and financial services that not only meet expectations, but exceed them.

🔹 To deliver clarity and confidence, no matter the complexity of your finances.

🔹 To stand by you with a stronger team, smarter systems, and unwavering commitment.

If you ever have a question, a concern, or just want to talk, I’m here.

Your trust matters more than ever.

Warm regards,

Matt

Let's Connect

Reserve a call or in-person meeting

Schedule a complimentary consultation or year-end review by calling 239-278-0762.

You can also schedule on My Calendar or reach out to admin@vmgfin.com by email.

Let’s ensure your financial future stays on track.

Disclaimer: The information provided in this communication is for informational purposes only and should not be construed as investment advice or a recommendation to buy or sell any particular security or investment. Past performance is not indicative of future results, and all investments involve risk, including the potential loss of principal. It is important to conduct your own research and consult with a qualified financial advisor before making any investment decisions. The opinions expressed herein are those of the author and do not necessarily reflect the views of the firm. This material is based on information believed to be reliable, but no warranty is given regarding its accuracy or completeness.